The Milestone Mastercard is a financial instrument for anyone wishing to create or repair their credit history. This card is especially beneficial to folks with less than excellent credit since it does not demand a security deposit. The following section delves into the intricacies of applying for a Milestone card, including its features and critical concerns.

Milestone Mastercard Overview 2024

| Feature | Description |

|---|---|

| Credit Limit | Access to a $700 credit limit without a security deposit, suitable for various credit profiles. |

| Security Deposit | No deposit required, making it easier for those with less than perfect credit to get a card. |

| Credit Reporting | Regular reporting to the three major U.S. credit bureaus to help build your credit history. |

| Card Acceptance | Mastercard is widely accepted online, in stores, and in apps across the globe. |

| Account Access | Round-the-clock access to account information via mobile and online platforms. |

Essential Milestone Credit Card Apply Requirements

| Fee | Details |

|---|---|

| Annual Fee | $35 to $99 based on creditworthiness |

| Purchase APR | 24.90% (variable) |

| Cash Advance APR | 29.90% (variable) |

| Foreign Transaction Fee | 1% |

| Late Payment Fee | Up to $40 |

| Overlimit Fee | Up to $41 |

| Cash Advance Fee | $0 first year, then $5 or 5% of the transaction |

Apply Requirements:

Here are the basic conditions you must complete to apply for a Milestone Credit Card, given in an easy to understand format:

- Age Requirement: You must be at least 18 years old to apply (19 in Alabama).

- U.S. Residency: You need to apply from a U.S. IP address, indicating you are within the United States at the time of applying.

- Social Security Number: A valid Social Security number is required for identity verification and credit check purposes.

- Physical Address: You must provide a physical mailing address (no P.O. Boxes).

- Email Address: An active email address is needed to receive communications regarding your application and account.

- Income and Expenses: You will need to provide details about your monthly income and expenses to assess your financial stability.

- Credit History: While designed for those with less than-perfect credit, your overall credit history may still be considered during the application process.

- No Previous Charge offs: You should not have had a Milestone card account that was charged off due to delinquency.

How to Apply for the Milestone Credit Card Online?

The procedure of applying for the Milestone Credit Card online is uncomplicated. Here are the actions to take:

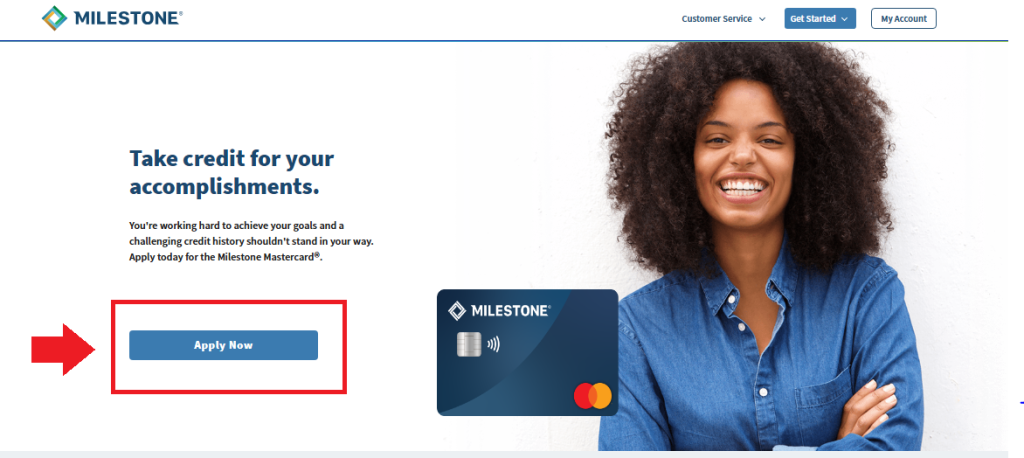

Step 1: Visit the Official Site:

- Go to the Milestone Card’s official website.

Step 2: Next, click on “Apply” link:

- Then, click on the “Apply” button.

Step 3: Check Eligibility:

- Optionally, you may check your pre-qualification status on the website. This step is beneficial as it doesn’t impact your credit score with a hard pull.

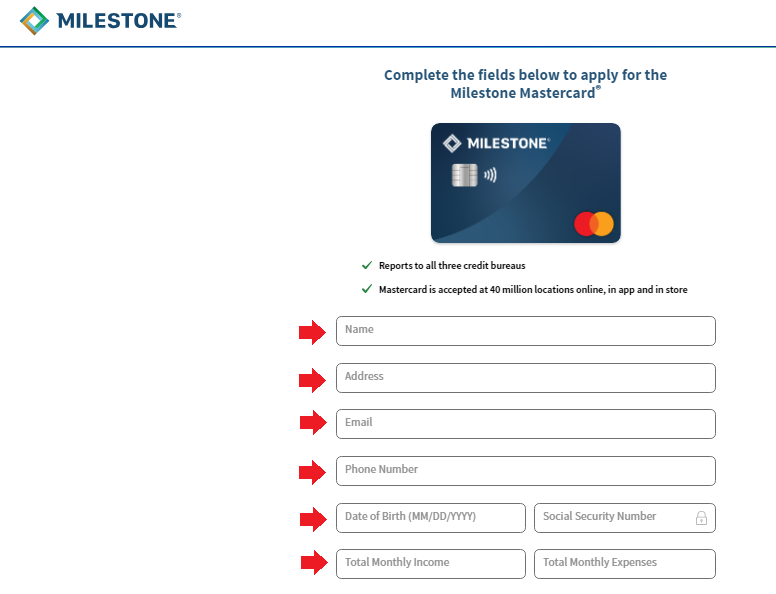

Step 4: Fill Out the Application:

- Complete the application form by providing necessary details such as your name, address, date of birth, Social Security number, and financial information.

Step 5: Submit the Application:

- Review your information for accuracy and submit your application.

Step 6: Wait for Approval:

- After submitting, you will typically receive an immediate response. If further review is needed, you might receive a decision shortly or be instructed to check back.

Step 7: Follow Up:

- If you don’t receive immediate approval, you can check the status of your application through the website or by contacting customer service.

Applying for the Milestone Credit Card Quick Details

Pre-Qualification: Check your eligibility online without affecting your credit score by entering simple information such as your name, email address, phone number, date of birth, and Social Security number.

Invitation Code: If you got a pre-qualification offer that included an invitation code, enter it to complete and submit the full application on the Milestone website.

Direct Application: If you do not have an invitation code, you may apply directly via the Milestone website. You will be asked to input your personal information (name, date of birth, Social Security number), as well as contact information.

Using Your Milestone Card

Once approved, you will get your Milestone Mastercard in the mail between 8-14 business days. After getting the card, you must activate it online and create an account to control your card activity.

Pros and Cons

1. Pros

- Qualify with Bad Credit: Designed for individuals with poor credit.

- No Security Deposit: Provides unsecured credit.

- Credit Bureau Reporting: Helps build credit history.

2. Cons

- High Annual Fees: Depending on your creditworthiness, the annual fee can be up to $99.

- Low Credit Limit: Initial credit limit is $700 with no increase options.

- High APR: High interest rates on purchases and cash advances.

Conclusion

The Milestone Mastercard is a realistic choice for people who want to rehabilitate their credit without having to pay a security deposit. While it has significant downsides, such as hefty fees and a limited credit limit, the benefits of helping to improve credit scores may exceed these negatives for many customers.

FAQs

Q1. Can I pre-qualify for the Milestone Credit Card without affecting my credit score?

Ans: Yes, checking if you pre qualify is a soft inquiry, which does not impact your credit score.

Q2. What is the credit limit for the Milestone Credit Card?

Ans: The starting credit limit is generally $700, depending on your creditworthiness.

Q3. Does the Milestone Credit Card require a security deposit?

Ans: No, the Milestone Credit Card does not require a security deposit.

Q4. Can I use the Milestone Credit Card internationally?

Ans: Yes, the Milestone Credit Card is accepted internationally, but a 1% foreign transaction fee applies.

Q5. How can I make payments on my Milestone Credit Card?

Ans: Payments can be made online, by phone, or through the mail, but there is no mobile app available for payments.